Get Business Car Loan Offers From Over 50 Lenders

We help you find the right business loan for your next vehicle purchase with no hidden fees.

- Rates from as low as 5.99%

- Fast approvals, in as little as 1 hour

- Borrow from $15K to $500K

See Why Business Owners Trust Us

5 stars all the way for Jomel from national loan!! What a superstar. Helped me all the way from the first to contact to final contracts. Would 100% recommend Jomel and will use him in the future for my buisness loans down the track👍

Courtney from National Loans provided an outstanding experience! The application process was quick and easy, and she was incredibly helpful and responsive. Courtney tailored the loan to fit my business needs perfectly and got it approved faster than I expected. Highly recommend for their exceptional service and efficiency!

Matt (Smithy) at National Loans made this whole process effortless and quick!! He brought a wealth of knowledge in determining what would be the best option for our business. In less than a week we had a loan approved and a car delivered. Would not hesitate in recommending or using Smithy @ NLs again in the future.

To say I am impressed is an understatement. Matt Shaw and his team at National Loans have supported my business for years now with fantastic financial packages for vehicles. Their service and availability to help is always just outstanding.- thank you… :)

Devin has been very professional, prompt and proactive. He has made the process of obtaining a business loan for our vehicle very easy. I would recommend his service to anyone.

I highly recommend using National Loans. Teo went above and beyond with everything that he did to help me purchase my ute. He gave great advice on how to secure a Ute after the first one I found, got sold from underneath me.

Awesome service, 10/10 would recommend. Always keeping you in the loop. Jomal was my broker and I would recommend him to everyone, whether he was texting me or giving me a call, he wasn’t just trying to get my business he was asking how my day was and how work was. 5 stars

I have never done anything finance before and I was assisted by Billie to get a loan sorted! He explained everything clearly and was very attentive. Best service would highly recommend Billie and will definitely use him again in the future if needed.

Brodie was unreal to work with. Easy going took the time to answer any questions i has if i didn’t understand anything and I could ring him if i needed anything. He kept me up to date with everything and with where the loan process was at, quick to reply and gave his honest opinions.

Competitive Business Car Loans For All Your Needs

Drive your business forward with car loan options designed for all types of business vehicles. Whether you're expanding your fleet or upgrading your current car, we will find the best rates for your needs.

Secure the assets your business needs with flexible Chattel Mortgage options. Enjoy the benefits of owning your vehicle from day one while tailoring your repayments to suit your cash flow, including the option of a balloon payment at the end.

If you’re a self-employed tradie, your vehicle is a major asset for your business. When it’s time to buy a new or used ute or work vehicle, a tradie car loan (also known as a sole trader car loan) can help you cover the cost with flexible terms that fit your needs.

Take your logistics to the next level with our truck and trailer financing solutions. Whether you're expanding your fleet or upgrading your existing truck, we provide competitive loans designed to meet the unique needs of transport businesses.

Drive your business forward with the right commercial van financing. Our flexible loan options make it easy to add or upgrade your vans, ensuring your business can deliver efficiently and keep growing.

Power your business with the right tools. From heavy machinery to essential equipment, we offer flexible financing to keep your business productive. Find competitive rates and terms that help your business reach its full potential.

Take Action, Secure Your Best Rate Today

Complete an online quote with us in less than 5 minutes and our expert team will help you with your specific business car loan needs to grow your business.

6 Reasons Why You Should Get A Business Loan with Us

Find Your Best Rate

We work for you to get you the lowest rate vehicle loans and lowest repayment.

Dive Access to 50+ Lenders

We have direct relationships with over 50 specialised bank and non-bank lenders.

Fast 1 hr Approval

Fast approval, in as little as 1 hour. Simple online application process.

We Protect Your Credit Score

We protect your credit score by matching you with the best lender the first time.

Over 25 Years Experience

25 years of industry experience sees us being able to access the lowest rates possible for each customer.

Fleet Prices & Top Used Car Selection

Free car finder service giving you access to new vehicles at fleet prices and a large selection of used cars.

6 Reasons Why You Should Get A Business Loan with Us

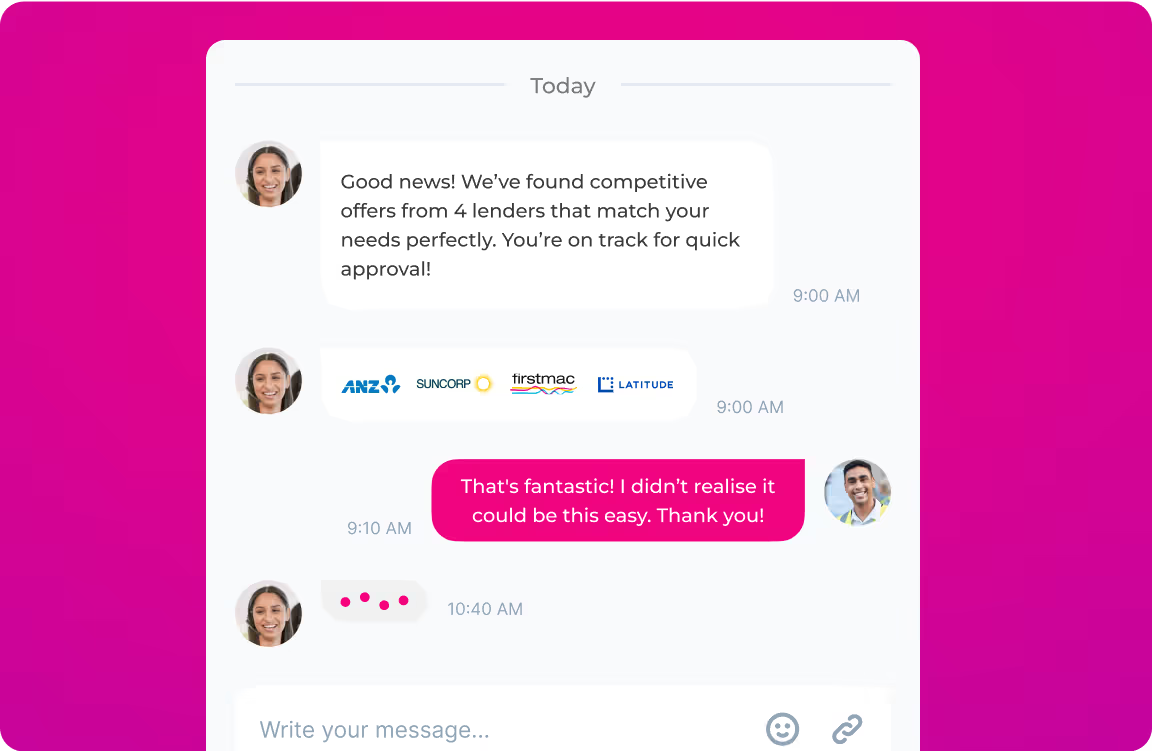

3 Easy Steps To Finance Your Next Business Car

Complete your online quote

Fill out our easy online application form in less than 5 minutes, and let our team of loan experts take it from there.

Pre-Assessment with Access to 50+ Lenders

Our team carefully reviews your application, protecting your credit file while sourcing competitive offers from our network of 50+ lenders.

Fast Approval and Funding Access

Receive approval in as little as 1 hour and secure the funds you need to drive your business forward.

Frequently Asked Questions

You can borrow anywhere from $15,000 to $500,000 for a business car loan, depending on your needs and eligibility. Whether you're looking to finance a single vehicle or a whole fleet, we have options to suit different requirements.

Business car loan interest rates can start as low as 5.99% per annum. The specific rate you qualify for will depend on factors like your credit profile and the loan type. Typical fees include an establishment fee and potentially ongoing monthly fees, but these can vary by lender and loan specifics.

To apply for a business loan, you'll typically need to provide documents that verify your identity, business registration, and financial standing. These may include your ABN or ACN, tax returns, bank statements, and financial reports such as profit and loss statements or balance sheets. Lenders may also ask for personal identification, proof of income, and details about the asset you intend to purchase. The exact requirements can vary depending on the lender and the loan type.

This is dependant on your circumstances. After receiving any supporting documents we may need, it is possible to receive an approval in as little as 1 hour.

You can finance a wide range of vehicles and equipment with a business car loan. This typically includes light vehicles such as cars, utes, vans, and motorcycles, as well as heavy vehicles like trucks, buses, and specialised vehicles. Additionally, business car loans often cover machinery on wheels, including forklifts, tractors, and excavators.

That’s absolutely fine, give our friendly team a call on 1300 358 358.

Yes, financing a business vehicle can offer several tax benefits. You may be eligible to claim deductions for vehicle expenses (such as fuel, maintenance, and insurance), depreciation, and potentially benefit from the instant asset write-off. If your business is GST-registered, you may also claim GST credits on the purchase. For specific advice, it’s best to consult with a tax professional to maximise these benefits.

A Chattel Mortgage allows you to own the vehicle from day one, with the loan secured by the vehicle. It offers potential tax benefits, such as GST credits and deductions, and provides flexible repayment options, including a balloon payment to lower monthly costs.

In contrast, a standard business car loan may not provide the same level of ownership flexibility or tax advantages and typically has different interest rates and fees. Chattel Mortgages are especially beneficial for businesses registered for GST due to the added tax benefits.

Yes, self-employed individuals or sole traders can apply for a business car loan, provided they have an active ABN that’s been registered for at least two years and intend to use the vehicle primarily for business purposes (more than 50% of the time). You'll also need to demonstrate your ability to repay the loan with appropriate financial documentation.

Yes, we have fantastic relationships with a large number of car dealers , giving us access to fleet pricing on new vehicles and a large selection of used cars

Ready To Find Your Best Rate?

Take action today, secure a great rate with us and start growing you business.

%201.avif)